Professor XIA Lijun's Paper Wins Title of the Most Influential China-related Paper in the Top Five International Journals of Accounting 2022-11-23

Since the mid-1990s, the process of internationalization has started in China's accounting research, and the international accounting community has begun to pay attention to the accounting and corporate governance issues in China's capital market. With the increasing importance of China's economy and capital market in the world, China-related research has attracted more attention from the international accounting community. In this context, the Journal of Accounting and Economics, an international top journal with the highest accounting impact factor, specially organized a summary seminar on China-related research findings of the past 20 years in 2021, which attracted extensive attention from the international accounting community.

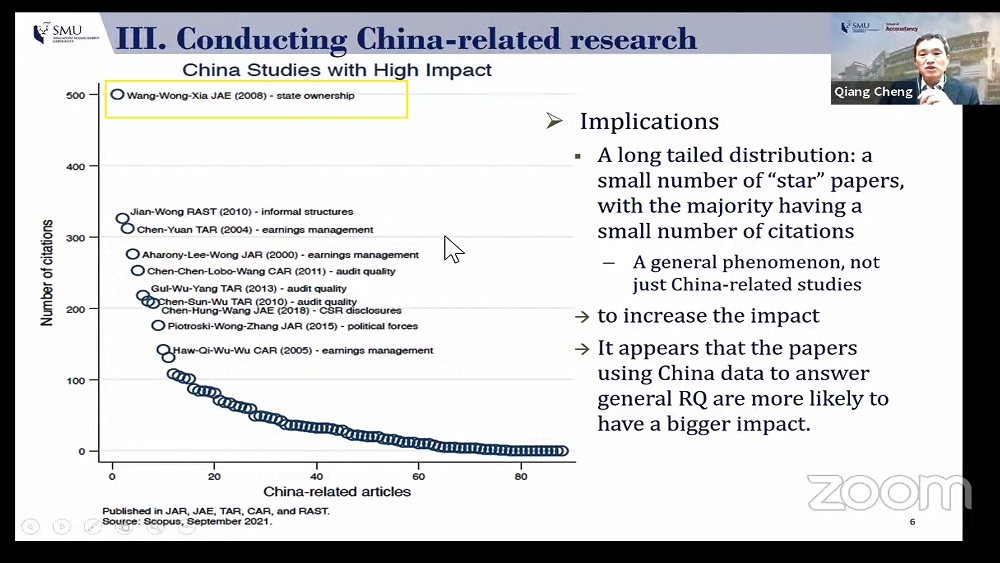

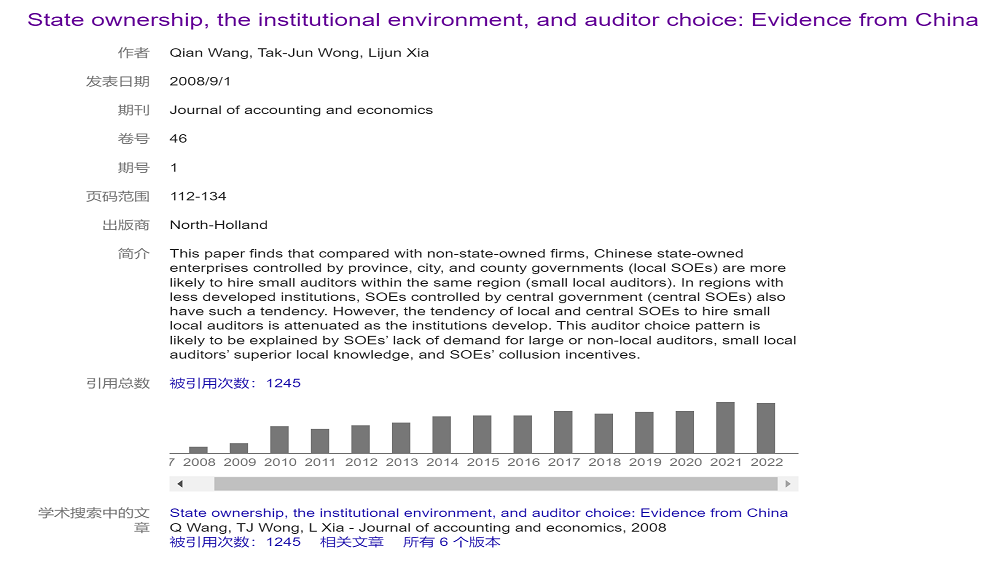

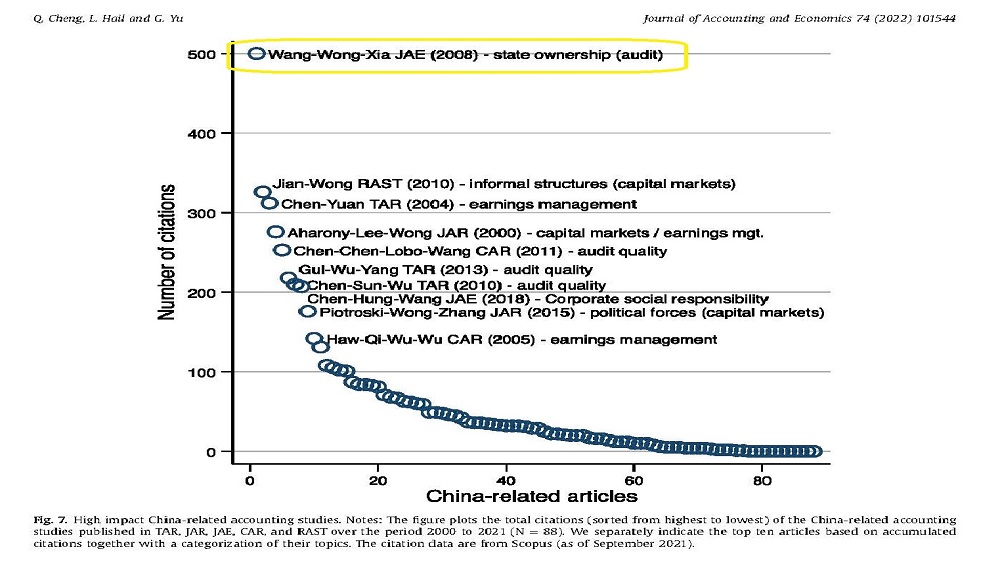

The main results of this summary seminar include one literature review and one review. In the reviews, Cheng, Hail and Yu (2022) analyzed the academic influence of 88 China-related papers published in the five top international accounting journals in the past 22 years (2000-2021). Professor Xia Lijun and Professor TJ Wong (the authors listed alphabetically by surname) published their paper "State Ownership, the Institutional Environment, and Auditor Choice: Evidence from China" (Wang, Wong and Xia, 2008) in the Journal of Accounting and Economics in 2008 and won the first place in the list of the most influential papers, with citation frequency significantly higher than the second ranked paper. Cheng, Hail and Yu (2022) further assigned China-related research into two categories: "general interest research using Chinese data" and "research on China's unique institutional scenarios". They considered the paper of Wang, Wong and Xia (2008) as the model of the second category, analyzed the reasons why the paper gained high influence, and pointed out that such research requires deep understanding of China's special institutional background, but can arouse extensive reading interest.

This paper of Professor Xia Lijun comes from the main content of his doctoral dissertation. The paper reveals why Chinese listed companies, unlike the mature capital markets where mostly the four major international auditors are hired, prefer to hire local and small-scale auditors. It provides answers to the institutional causes of the lack of demand for spontaneous high-quality accounting audit and corporate governance of Chinese listed companies. After the paper was published, it was widely and continuously cited by scholars worldwide (Google Scholar cited more than 1200 times, Scopus cited more than 500 times), triggering a lot of research on the institutional roots behind accounting audit and corporate governance in China's capital market.

Professor Xia Lijun has been committed to the institutional economics research of accounting and corporate governance in China's capital market for a long time. He has published more than 30 papers in the Journal of Accounting and Economics, The Accounting Review, Economic Research Journal, Management World, Accounting Research and other top or mainstream journals all over the world, published Chinese-style Capital Market, Corporate Governance and Enterprise Development and other works, led a number of key projects of the National Natural Science Foundation of China, the National Social Science Foundation of China, the key research base for humanities and social sciences of Ministry of Education and other major projects, and was selected into the talent training programs of the Ministry of Finance, such as the Accounting Master Training Project. His research findings have been widely cited by peers from all over the world.