With the development of new technologies like artificial intelligence, big data analysis, and blockchain, and the emergence of alternative data like social media data, textual data, and ESG data, a revolution is taking place in financial research. New technologies and new data not only provide us a broader perspective of financial research but also increase the knowledge and understanding of finance in academia and industry. Therefore, based on the cutting-edge research in finance, this symposium aims to arouse thinking and discussion, which promote academic exchanges and cooperation.

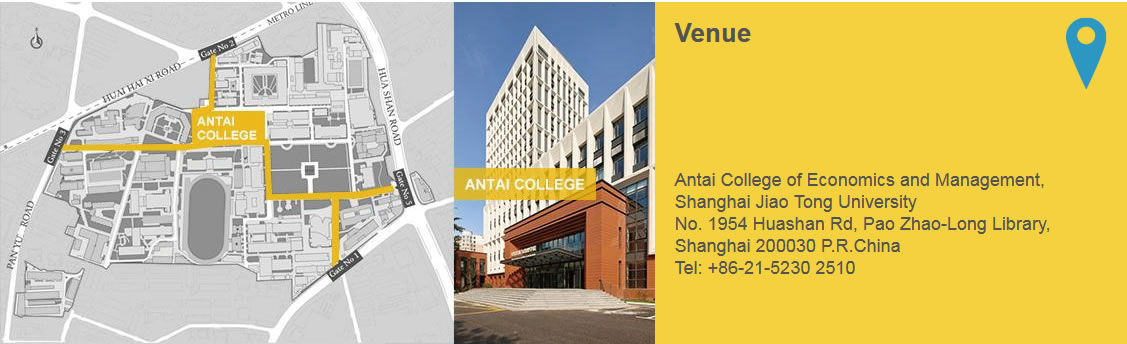

Antai College of Economics and Management (ACEM), Shanghai Jiao Tong University boasts a rich history and tradition which dates back to the Business School of Nan Yang Public School founded in 1903. ACEM is dedicated to educate economic and management talents with international competencies. It promotes scientific and academic innovation, caters to economic and social development, and supports the growth of business. After over 30 years’ unremitting efforts, ACEM has established itself as a modern business school with a good reputation home and abroad, and the first business school in mainland China to have been triply accredited by AACSB, EQUIS and AMBA, the three largest and most influential business school accreditation associations in the world.

| 07:40-08:00 | Welcome Speech |

| 08:00-08:30 | Paper 1: Predictable Price Pressure |

|

Samuel M. Hartzmark, University of Chicago David H. Solomon, Boston College Presenter: Samuel Hartzmark University of Chicago Discussant: Christopher Jones University of Southern California |

|

| 08:30-09:00 | Paper 2: Nowcasting firms’ fundamentals: Evidence from the cloud |

|

Ran Chang, Shanghai Jiao Tong University Zhi Da, University of Notre Dame Presenter: Ran Chang Shanghai Jiao Tong University Discussant: Samuel Hartzmark University of Chicago |

|

| 09:00-09:30 | Paper 3: Option Momentum |

|

Steven L. Heston, University of Maryland Christopher S. Jones, University of Southern California Mehdi Khorram, Louisiana State University Shuaiqi Li, London School of Economics Haitao Mo, Louisiana State University Presenter: Christopher Jones University of Southern California Discussant: Jie Cao The Chinese University of Hong Kong |

|

| 09:30-09:45 | Break Time |

| 09:45-10:15 | Paper 4: Asset Pricing with Panel Trees Under Global Split Criteria |

|

Xin He, City University of Hong Kong Lin William Cong, Cornell University Guanhao Feng, City University of Hong Kong Jingyu He, City University of Hong Kong Presenter: Lin Will Cong Cornell University Discussant: Alberto Rossi Georgetown University |

|

| 10:15-10:45 | Paper 5: Policymakers’ Uncertainty |

|

Anna Cieslak, Duke University Stephen Hansen, Imperial College London Michael McMahon, University of Oxford Song Xiao, London School of Economics Presenter: Anna Cieslak Duke university Discussant: Nan Li Shanghai Jiao Tong University |

|

| 10:45-11:15 | Paper 6: Goal Setting and Saving in the FinTech Era |

|

Antonio Gargano, University of Houston Alberto G. Rossi, Georgetown University Presenter: Alberto Rossi Georgetown University Discussant: Sean Cao Georgia State University |

|

| 17:00-18:00 |

Keynote Speech:The Big Tech Lending Model Wei Xiong, Princeton University Speaker: Wei Xiong Princeton University |

Arthur F. Burns Professor of Free and Competitive Enterprise

Moise Y. Safra Professor of Finance

Trumbull-Adams Professor of Finance and Professor of Economics