Statement on Donation Tax of Shanghai Jiao Tong University Education Development Foundation and Specimen of Donation Receipt 2022-05-14

Statement on the Tax on Donations of Shanghai Jiao Tong University Education Development Foundation

I. Tax laws and regulations on donations in China

1. The Enterprise Income Tax Law of the People's Republic of China (2018 Amendment) has been adopted at the 7th Meeting of the Standing Committee of the 13th National People's Congress on December 29, 2018.

Article 9: As to an enterprise's expenditure for public welfare donations, the portion allowed for deduction when calculating the taxable income amount shall be limited to 12% of the total profits for the year; the exceeding part may be carried forward and deducted from taxable income within three years.

2. The Individual Income Tax Law of the People's Republic of China (2018 Amendment) has been adopted at the 5th Meeting of the Standing Committee of the 13th National People's Congress on August 31, 2018.

Article 6 ......Amounts donated out of individual income to education, poverty alleviation or other public welfare undertakings, can be deducted from the taxable income, so long as the donation does not exceed 30 percent of the declared taxable income. Where the State Council stipulates that the full amount of a donation made to public welfare undertakings shall be deducted from the taxable income, such provisions shall prevail. ……

3. The Regulations on Implementation of the Individual Income Tax Law of the People's Republic of China have been promulgated by Decree No.707 of the State Council of the People's Republic of China on December 18, 2018.

Article 19: Donation made out of individual income to education, poverty alleviation or other public welfare undertakings as referred to in Article 6.3 of the Individual Income Tax Law means any donation made out of individual income to education, poverty alleviation or other public welfare undertakings through any public welfare social organization or state organ in China; the term "taxable income" refers to the amount of taxable income before the deduction of the donation amount.

II. Tax deduction available for donations to SJTU

1. Introduction to the qualification of Shanghai Jiao Tong University Education Development Foundation for pre-tax deduction of donations as a public welfare unit: Announcement of Shanghai Municipal Finance Bureau on the List of Shanghai's Public Welfare Social Organizations Qualified for Pre-tax Deduction of Donations in 2019 (the Third Batch) (issued on March 26, 2020; please see Annex 1).

That means: when a domestic enterprise donates to Shanghai Jiao Tong University Education Development Foundation, the expenditure from such corporate behavior shall be a public welfare donation expenditure, the amount of which not exceeding 12% of the total profit for the year can be deducted from the taxable income. For example, if the annual taxable income is RMB 42 million and the amount of donation is RMB 5 million, then the income tax shall be calculated based on an adjusted amount of RMB 37 million.

2. Shanghai Jiao Tong University (Hong Kong) Education Foundation is registered in Hong Kong and since January 12, 2015, it is exempt from tax under Section 88 of the Inland Revenue Ordinance as it is a charitable institution or trust of a public character (see Annex 2).

3. Shanghai Jiao Tong University Foundation of America is registered in California, USA, with a tax number 76-0802983. Now it is classified as a 509 Private Foundation that qualifies for US federal tax exemption under Section 501 (c) (3) of the Internal Revenue Code (please see Annex 3). Donations up to one-third of an individual's annual income are tax-free, and the excess may be applied to offset tax in the following year for up to five years.

Shanghai Jiao Tong University Education Development Foundation

April 6, 2020

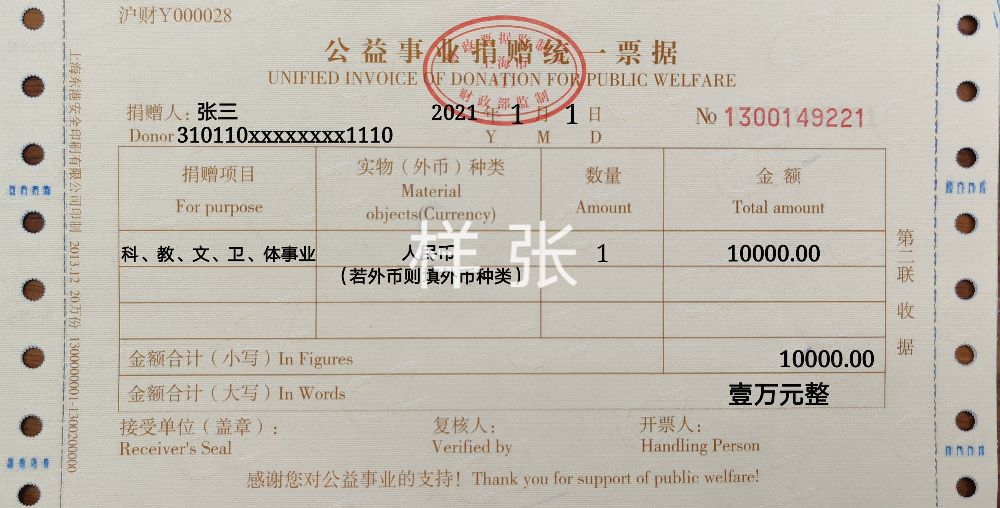

The Notice of Shanghai Municipal Finance Bureau and Shanghai Municipal Taxation Bureau, State Administration of Taxation on Issues Related to Pre-tax Deduction of Public Welfare Donations Made through Public Welfare Mass Organizations (HCF (2020) No. 8) stipulates that "For individuals who ask for a receipt, the name of the donor and the type and number of ID document shall be indicated." The donor shall provide the ID card/corresponding ID number, and make the deduction before the declaration of enterprise income tax and individual income tax according to the tax law.

Annex: Specimen of Unified Invoice of Donation For Public Welfare